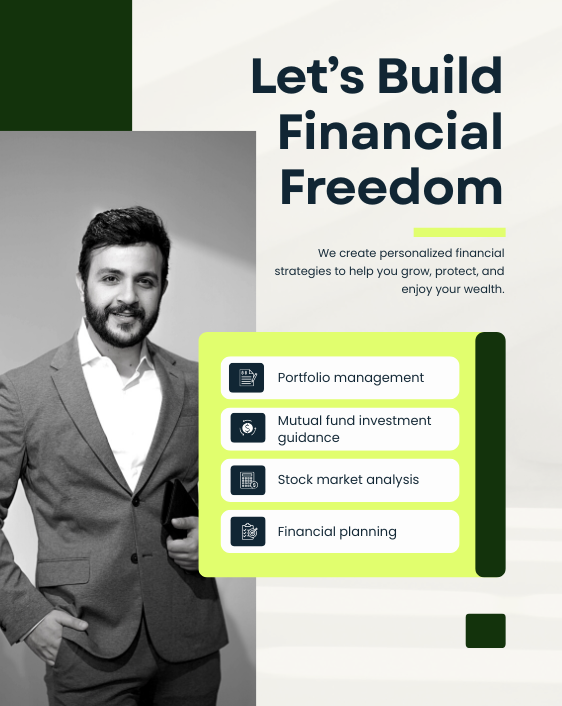

Why choose us?

Your Trusted Investment Advisor in India

Expertise in Diverse Investment Options: We offer personalized advice on a wide range of investment avenues, including mutual funds, stocks, bonds, and more, catering to both beginner and seasoned investors.

Tailored Investment Strategies: Our team provides customized investment solutions based on your financial goals, risk tolerance, and time horizon, ensuring you make informed decisions.

Transparency and Trust: At Nivesh4U.com, we prioritize transparency and clear communication, ensuring that every investment decision is made with complete understanding.

Proven Track Record: With years of experience in the investment advisory industry, we have consistently helped our clients grow their portfolios and achieve their financial goals.

Client-Centric Approach: Our focus is always on what’s best for you, providing unbiased advice and continuous support to help you navigate the ever-changing financial landscape.

Comprehensive Support: From initial consultations to ongoing portfolio management, we are with you every step of the way, ensuring your investments stay aligned with your long-term objectives.

Our Mission

At Nivesh4U, our mission is to empower individuals and businesses in India with personalized, insightful, and strategic investment advice. We are committed to providing tailored solutions that help our clients navigate the complexities of the financial world, achieve their financial goals, and secure long-term wealth through informed decision-making.

Our Vision

To be the leading investment advisory platform in India, known for our integrity, expertise, and innovation. Our vision is to make investment knowledge accessible to all, creating a future where every investor is equipped with the tools, resources, and strategies to succeed in their financial journey.

Growth

Our Digital Strategists will help you in

building your digital solutions right.